A note on Degrowth

Photo | Landscraper

[…] the essence of development consists of the organizational and flexible power to create new processes rather than the power to produce commodities by materially crystallized plants.

N. Georgescu-Roegen 1971, p. 275

1 The degrowth debate

There is a vivid, on-going debate about “what degrowth is” in the scientific literature. The researchers involved having very diverse background, e.g. philosophy, political science, economics, ecology, engineering. I try here to highlight both the points in common and the differences, in an interdisciplinary and pragmatic perspective, and – possibly – smoothing the divisions.

On the political side, right and left policymakers are divided about the crisis cure, debating about the degree of fiscal redistribution (income tax, Tobin tax, minimum and maximum wages) and state spending (infrastructures for schools, roads, trains, public water resources). Degrowth perspective lying at the extreme left of the political spectrum. This is – I believe- mainly due to the fact that crisis means unemployment and the degrowth concept and proposal sounds as heresy to the majority of representatives since GDP de-growth is associated with increase in unemployment.

On the academicals side, van den Bergh (2011) and Kallis (2011) recently synthesized the ecological and degrowth economics perspectives respectively. The former detailing the terrain vague of degrowth proponents: GDP, consumption, work-time, radical or physical degrowth? van den Bergh detailed an ontological critique: “GDP degrowth means a blunt instrument of environmental policy which reverses the causality between policy and growth as it is normally understood. Instead of putting a good policy first and then seeing whether degrowth is a consequence, the degrowth strategy is to set the aim of degrowth first and then hope that the environment will come out well” (van den Bergh, 2011, p. 882). Instead, he proposes “a-growth” as a political strategy based on beyond-GDP indicators, international climate agreement, different work-time norms, advertisement regulations, sustainability school programs and technological specific incentive policies.

Kallis’ defense of degrowth hypothesis (Kallis 2011, 2012) starts by widening the definition: “It is an umbrella keyword, a multifaceted framework that gives purpose and connects different policies and citizen initiatives. And it is a concept that builds on a deep and long philosophical, cultural, anthropological and institutional critique of the notions of growth and development..” (Kallis 2011, p. 874). He specifies then: “Sustainable degrowth can be defined form a ecological-economic perspective as a socially sustainable and equitable reduction (and eventually stabilization) of society’s throughput” (ibid.). Throughput meaning materials and energy, whose reduction implies GDP reduction because of the dependence of economic growth on non renewable energy and materials (decoupling and efficiency are illusionary)1.

The pessimistic view of the degrowth movement about the possibilities offered by technological progress to allow growth with less resources (decoupling) is shared by the societal metabolism proponents (Sorman and Giampietro 2012, Giampietro et al. 2011). They defy the Environmental Kuznets Curve (EKC) and decoupling hypothesis using a multi-scale analysis (MuSIASEM) detailing energy, people (measured in hours) and money at the economic subsector level. Their analysis denies the possibility of reduced exhaustible resource dependence, showing instead how it is the externalization of “heavy” (in energy and materials) production in emerging economies (e.g. BRICS) which explains the reduced energy, pollution and waste in modern, service-based economies.

A major disagreement between societal metabolism and ecological economics supporters with Kallis (and the degrowth partisans in general) concerns the (shorter) working time as part of the economic downsizing. Sorman and Giampietro (2012) explain the societal metabolism approach to analyze the present crisis: high unemployment and low wages in a world dealing with less energy and materials might well lead the way to labour intensive products and this is likely to equal more working hours as the diminishing high capital productivity will have to be compensated by increasing low productivity labour. Sorman and Giampietro (2012) use MuSIASEM (Giampietro and Mayumi 2000a, b) to show how the service and government (S&G or “dissipative”) sector employs the majority of people and does not produce neither energy, products or food, but services. On the other hand it belongs to the energy and mining (EM), agricultural (AG) and building and manufacturing (BM) productive (or “hypercyclic”) sectors to “feed” the rest of society. This “hypercyclic” sector is characterized by very little employment and huge capital and energy resources, thus a reduction of available energy will hit badly both “hypercyclic” and (fragile) “dissipative” societal sector. Also a low output/input renewable energy resource – to substitute high output/input fossils – will not change the course of things. No smooth transition is in sight according to the societal metabolic researchers.

2 An intuitive rationale of the economic process

I propose here a schematic representation of the economic process, centered on supply and demand, to highlight the field of intervention.

On the supply side. The entrepreneur theory postulate he maximizes profit, in reality he tries to maximize output, expanding the firm, increasing the capital etc. In search of economies of scale. With respect to neoclassical economic theory, firms are not atomistic, rather giants with sophisticated financial architecture.

Modern superstructure. The quantity-maximized products are first structured by the marketing departments, then advertized by the pervasive media world, which creates an fast-changing collective imaginary of ever-increasing consumption ambitions. Magazines, TV and internet keep feeding the demand and generating a collective oblivion about both material waste and depletion (double myopia).2

On the demand side. The consumer identifies consumption with happiness, social success and status symbol are no more related to fixed (middle-ages ) classes. Money moves between social strata, but inequality increased greatly also. Income inequality has increased since the ’80 by so-called “supply-side” fiscal policies aimed at reducing the fiscal burden on high income and enterprises.

These policies (“reaganomics” or “thatcherism”, inspired by Milton Friedman word-wide influence) have meant important gains for few riches and reduced income for the State. A fiscal deficit often compensated with cuts on schools, hospitals, infrastructures and other public services. Moreover, this extra gain very seldom is directed to productive investment, but rather goes to more financial investments to feed the international paper-economy (local impoverishment).

The markets globalization and concentration (fall of Eastern Europe, WTO agreements) has been helped in the past 20 years by the diffusion of information and communication technology. Companies have merged, rationalized their production in function of resources, energy, labour costs and fiscal opportunities. This was possible thanks to cheap fossil energy: cheap energy = more energy = more capital = more production (see below). This process went together with less labour and low wages, because of (accounted) low labour productivity in highly-capitalized firms.

On the other hand, the expansion of credit, motivated by new financial products vehiculated via electronic, instant trading, resulted in a continuous bet on growth, generating an ever-increasing debt. Virtual money (financial products value) is estimated to be 1000 times world GDP.

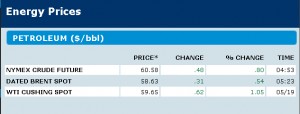

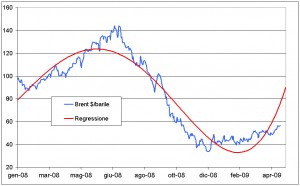

The end of easy, abundant energy broke the circle: 100$/barrel oil is the missing link between 1) the inner fragility of the financial bet; 2) the minimum margins of the producers and 3) the lowered purchasing power of impoverished consumers. This – I believe – explains the crisis.

It is this (unknown?) feature of the capitalistic economic process which clashes with sustainable (be it stable or reduced) throughput. A clear example is offered by public utilities dealing with electricity, gas, water or waste: should they try to “sell more”? Clearly not.

To help solving this, energy and material statistical accounting (OECD 2008a, b) is a crucial issue (and needs public investment in statistical offices) in order to enable the evaluation of the effective sustainability of societies in the close future. Nevertheless, at the core of capitalistic process there are:

- The rational output maximization attitude of the firm

- The emotional eros3 for new, more and more expensive4 goods of the consumer

Both mechanisms create a continuous demand for energy and materials. In standard economic analysis, this phenomenon is known energy (and materials) complementarity with GDP (Daly 1997). To keep the standard production function representation for a while, we can mention that the flexibility of the economic process with respect to energy price and quantity shock relates to the elasticity of substitution between inputs.

It is a long debate going back to early economic history (Allen 1938, Berndt and Wood 1975, Blackorby and Russell 1989, Frondel and Schmidt 2004, Koetse et al. 2008) recently being investigated by Fiorito and van den Bergh (under review), whose results show how energy and capital are not good substitutes, but rather complementary, even in periods of cheap, abundant energy.

Moreover, the now huge influence of the financial sector on the real economy explains the ever increasing pressure of financial over the manufacturing sector (Gallino 2011). This translates into more sales for “Main street”. Firms need exponential sales…to survive!

Mayumi and Tanikawa (2012: 20) synthesized well an integrated view of the economic process:

“According to Georgescu-Roegen the economic process does not produce goods and services, but it produces a reproducible system, via the establishment of an integrated process of production and consumption of goods and services. When dealing with the analysis of the economic sectors – those producing added value – they not only produce goods and services, but also produce those processes required to produce and consume goods and services. When considering the whole socioeconomic system, it is the integrated action of the productive economic sector and the sector of final consumption which has to be considered. Using Georgescu-Roegen’s terminology, the economic process has the goal of reproducing and expanding the various fund elements defined simultaneously across different levels and scales, by using disposable flows. Following Georgescu-Roegen, we can conclude that an economy not only produces goods and services, but more importantly produces the processes required for producing and consuming goods and services“.

3 A feasible recipe?

In the last years, the historical need for social justice and equity between people (classes, in Marxist sense) has evolved into the domain of ecological sustainability, the environmental dimension having primed on the mere economic/monetary one. The commodity/food (2007), energy (2008), financial (2008 to present) and economic (2009 to present) crisis have shifted the sustainability concept from the political/ecological to the moral/psychological domain. In bullet points there is a wide understanding of the general public about:

- both global warming and resource scarcity;

- nature’s “economic” limits (energy/resource supply and emissions/wastes sink capacity);

- finance’s eternal bet on exponential growth (“Ponzi” economics, Giampietro et al. 2011);

- national and international inequalities rise (99%, indignados and occupy movements);

- the consequences of the 4 points above in everyone’s wallet:

All this – I believe – have brought ethical and ecological to become synonyms in the collective consciousness.

On a political side, stabilizing the (exponential growth) influence of finance toward real economy goes along with some fiscal actions shifting the burden form labour to capital. Namely,

- Tobin tax on financial (short term) transactions;

- strict derivatives regulation (e.g. no derivatives on commodities, like in India, Credit Default Swap regulation);

- re-establishment of the separation between traditional and investment banks (e.g. Glass-Steagall Act);

- fiscal gains for strictly/serious green investment funds.

On the demand side, the specific reduction in income inequality is the basis for a socio-political change toward sustainability, because only dismantling money fetishism it is possible to stop low-life, high energy/material intensity products.

To reduce both inequality and (myopic) consumeristic attitude it is natural to envisage:

- minimum and maximum wages rules

- job guarantee program (continuous training for the unemployed)

- progressive income tax

- public and non-motorized transport infrastructure (trains, trams, cycling lanes)

- woods, rivers and material waste integrated restoration process

Setting the basis for a different homo at the political level is necessary to stimulate non-monetary, solidarity, cultural restoration activity. Such a path will only be economically profitable in the long term, but in the short run can gratify many, reducing distress and crime. In fact the necessary degrowth everybody agrees means less monetary activity not less work, which, important to say will be necessary anyway. An example is food: the transition to low fossil energy and material society implies a population flow to the land where small scale, local, organic agriculture will be the norm. In this sense the emancipation from the land was really temporary (Mayumi 1991).

References

Berndt, E.R. and Wood, D. O. (1975), Technology, Prices, and the Derived Demand for Energy, The Review of Economics and Statistics, Vol. 57, 259-268

Blackorby, C. and Russell, R.R. (1989), Will the Real Elasticity of Substitution Please Stand Up? (A Comparison of the Allen/Uzawa and Morishima Elasticities), The American Economic Review, 79, 882-888

Daly, H. (1997), Georgescu-Roegen versus Solow/Stiglitz, Ecological Economics 22, 261-266

Fiorito, G., van den Bergh, J.C.J.M. (under review), Capital-Energy substitution for Climate and Oil Peak: An International Comparison Using the EU-KLEMS Database, http://www.locchiodiromolo.it/blog/wp-content/uploads/2012/03/Fiorito-KE-substitution-for-Climate-Oil-Peak.pdf

Fiorito, G. (under review), Can we use the energy intensity indicator to study “decoupling” and “dematerialization” in modern economies?, Journal of Cleaner Production, http://www.locchiodiromolo.it/blog/wp-content/uploads/2012/08/Can_we_use_EI.pdf

Frondel, M., Schmidt, C.M. (2004), Facing the truth about separability nothing works without energy, Ecological Economics 51, 217-223

Gallino, L. (2011), Finanzcapitalismo. La civiltà del denaro in crisi, Einaudi

Georgescu-Roegen, N. (1971), The entropy law and the economic process. Harvard University Press

Giampietro, M., Mayumi, K. (2000a), Multiple-scale integrated assessment of societal metabolism: introducing the approach. Population and Environment 22 (2), 109-153.

Giampietro, M., Mayumi, K. (2000b), Multiple-scale integrated assessments of societal metabolism: integrating biophysical and economic representations across scales. Population and Environment 22 (2), 155-210

Kallis, G. (2011), In defence of Degrowth, Ecological Economics 70, 873–880

Kallis, G. (2012), Societal metabolism, working hours and degrowth A comment on Sorman and Giampietro, Journal of Cleaner Production, DOI: 10.1016/j.jclepro.2012.06.015

Koetse, M.J., De Groot, H.L.F., Florax, R. (2008), Capital-energy substitution and shifts in factor demand: A meta-analysis, Energy Economics 30, 2236–2251

Mayumi, K. (1991), Temporary emancipation from land: from the industrial revolution to the present time, Ecological Economics 4, 35-56

Mayumi, K. and Tanikawa, H. (2012), Going beyond energy accounting for sustainability: Energy, fund elements and the economic process, Energy 37, 18-26

OECD (2008a), Measuring Material Flows And Resource Productivity, Volume II, The Accounting Framework

OECD (2008b), Measuring Material Flows And Resource Productivity, Volume III, Inventory of Country Activities

Sorman, A., Giampietro, M. (2012), The energetic metabolism of societies and the degrowth paradigm:

analyzing biophysical constraints and realities, Journal of Cleaner Production, DOI:10.1016/j.jclepro.2011.11.059

van den Bergh, J.C.J.M. (2011), Environment versus growth — A criticism of “degrowth” and a plea for “a-growth”, Ecological Economics 70, 881–890

1. Energy intensity as a white noise indicator implying energy-GDP correlation is investigated in Fiorito (under review).↩

2. In the information society not only advertisement, but also economic transparency increased significantly, leading the basis for informed consumer and universal workers rights (“where” added-value goes).↩

3. In the original Greek meaning of “tension toward”.↩

4. Expensive often equals intensive in Energy and materials.↩